How Ohio Tax Laws Affect your Money and Investments

Are you aware of recent and upcoming changes to Ohio’s tax brackets and laws? Recent changes in the Ohio tax laws, as well as scheduled changes to federal estate taxes may have significant effects on you and your family.

First, let’s look at what you should expect from Amended House Bill 33 in Ohio. The recent changes may impact your finances – you may need to adjust your financial strategies. Lakehouse Family Wealth’s team consistently works with professionals who understand financial, tax, and estate issues. Below we break down how the new and current laws may influence your wealth management strategies.

Home Ownership Savings

Ohio tax changes beginning January 1, 2024, include an income tax deduction available for amounts contributed to home ownership savings deposit accounts. This Ohio tax deduction is allowed up to a maximum of $10,000 per year for married couples filing jointly and $5,000 per year for individuals, with a lifetime maximum of $25,000. Interest earned on the savings and contributions to those accounts are also eligible for deductions. You may be able to include contributions from participating employer programs. Be careful - earmarked savings in home ownership accounts that are removed and used for other purposes will incur state income taxes.

How Tax Laws Influence Personal Income Tax

First , let’s examine how the new tax laws could affect your personal income. Your income

sources may include:

- Earned income – W2 type income from employment.

- Passive income – income from rental property, for example

- Portfolio income from savings and brokerage accounts – interest, dividends, and short and long-term capital gains

- Social Security income

- Pension income

Earning money from almost any activity counts as part of your income in Ohio. Therefore, you pay taxes on your total annual income called a personal income tax. Learn about whether you’ll notice recent Ohio tax changes, described below, in your tax payments.

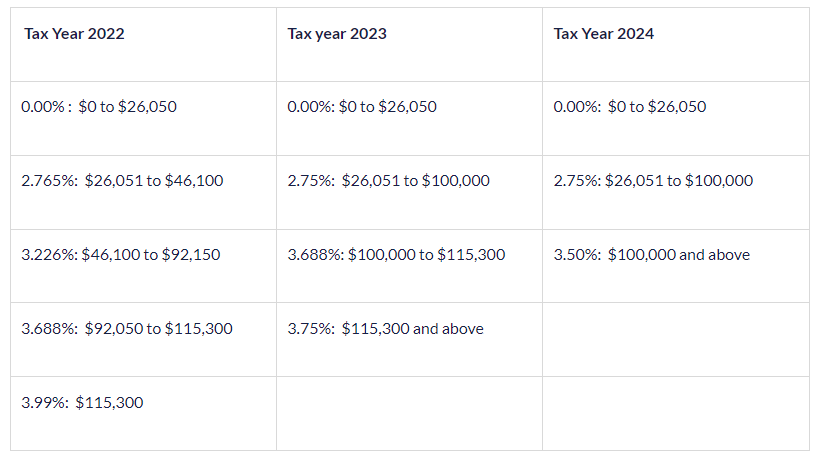

Ohio Tax Bracket Changes

Ohio adjusted income tax rates were signed into law July 3, 2023. These changes affect the 2023 and 2024 tax years. Many taxpayers are likely to find the changes favorable. In 2023, the brackets are reduced from four to three. Also, the highest and lowest tax rates are reduced. In 2024, the top two brackets will be combined into a single bracket with the rate lowered to 3.5%.

The changes are outlined in the chart below.

The Significance of Estate Taxes on Wealth Management

The State of Ohio repealed estate taxes in 2013 having a profound impact on how Ohio residents manage their assets and engage in estate planning. Many state governments collect a tax, known as an estate tax, following a person’s death prior to any inheritance transfers to loved ones named in the deceased person’s will.

Since Ohio no longer collects an estate tax, this means less planning for state taxes for most people. There are exceptions. While you do not have to worry about the State of Ohio claiming a portion of your estate for taxes, you may have beneficiaries living in other states. Those states could require a portion of the value of inherited assets be paid as taxes to that state. Similarly, you may be a beneficiary and owe estate taxes if the deceased person was a resident of a different state. Pennsylvania, for example, requires heirs in other states to pay an estate tax to Pennsylvania

Federal Estate Taxes

You may have heard about some taxes being referred to as “death taxes”. Federal and state estate taxes are paid from the assets of your estate before remaining assets can be distributed to your heirs.

Estate taxes are charged against the value of your estate – what you own – when you die. This is a tax for the right to transfer your property to someone else at your death. The value of your estate is based on the total value of your cash investments, property, and other assets. This value may vary from what you expect based on how accounts are titled, types of investment accounts and other factors.

Generally, inheritance taxes are usually not considered taxable income by the federal government. Your relationship to your heirs may affect their tax situation depending on how an asset held and how it is transferred. Surviving spouses are usually exempt from estate taxes. However, widows and widowers may face several tax challenges, in tax years after the death of their spouse, that relate to their own ongoing income taxes and Medicare premiums.

The federal government has an estate tax, unlike Ohio. A federal inheritance tax is due when an estate’s value exceeds $12.92 million per individual. While this amount may lead many to believe an estate tax will not be levied on their estate, this higher exemption threshold is set to expire at the end of 2025. It is unknown how tax laws may change in the future. It is never too soon to consider estate taxes in your financial planning. Many families who take the wait and see what happens approach may lose the ability to make appropriate financial and investment plans and thus save on estate taxes.

Holding assets in a trust may make sense in some situations. There are multiple types of trusts, each with varying tax implications and advantages and disadvantages. Financial advisors and attorneys should be consulted before deciding to put any assets into a trust.

Many individuals and families can experience tax benefits now and after the death of a family member when tax considerations are part of financial planning. Investment considerations, including the following and others, all go into creating a tax efficient financial plan.

- types of accounts,

- how accounts are titled,

- tax efficient investments,

- use and timing of Roth conversions and Roth IRA’s,

- beneficiary designations,

- use of employer retirement plans and health savings accounts,

- charitable giving strategies,

- use of 529 plans for college planning,

- how to use stock options and other employer benefits,

- how to plan for and afford retirement

- how one spouse can afford to live after the death of the other spouse

- when to begin receiving social security, and

- how to pay for long-term care

A licensed financial advisor, who is a fiduciary, can help you navigate tax challenges and plan for your financial future.

What the Ohio Tax Law Changes Mean for Wealth Management in Ohio

Ohio’s tax bracket reductions mean that many people may save money when filing and paying state taxes. Your benefits from these changes may allow you to explore investments appropriate to you and your family that provide strategies to increase your savings and wealth – either actively or passively.

The deductions for holders of home ownership savings accounts represent a unique opportunity to build your legacy and estate further – even if you do not currently own property. These accounts provide benefits that can translate to years of future stability and financial security. The tax savings further provides you with opportunities to improve your wealth and retirement planning, whether through Roth IRA contributions or other investment strategies.

Remain vigilant of the changes in 2024 as well as the expected expiration of federal estate tax thresholds at the end of 2025. Seek advice from a trusted tax planning service to identify ways you can minimize your taxes. Also, seek advice from a trusted investment or wealth management advisor to customize your financial plan and grow your wealth. Everyone’s situation is different. A trusted wealth management firm can help you tailor your plan for life’s major events – whether retirement, a college tuition plan, a home purchase, or long-term care – all while considering what is most appropriate for you and your personal goals.

Finally, make sure you understand the implication of estate planning in Ohio and other jurisdictions that may affect you. Whether you recently purchased a home, inherited an estate, or intend to alter your will, it is important to understand how federal and state taxes influence your assets and your future.

Lakehouse Family Wealth Helps You Manage Your Retirement Plan Lakehouse Family Wealth’s team of experienced financial professionals is ready to help you build a stable financial foundation. We understand that wealth management in Ohio requires personalized solutions and services that consider your unique situation, family, assets, and goals.

Our philosophy for financial planning takes a holistic approach. Lakehouse Family Wealth professionals look at the big picture for you – not just one investment account -- to help you and your family achieve your goals throughout your life, including retirement. We remain active with our clients to continually monitor and tailor investment and other financial strategies that make sense for them. Contact us for a free financial assessment.

The Lakehouse Family Wealth Blog